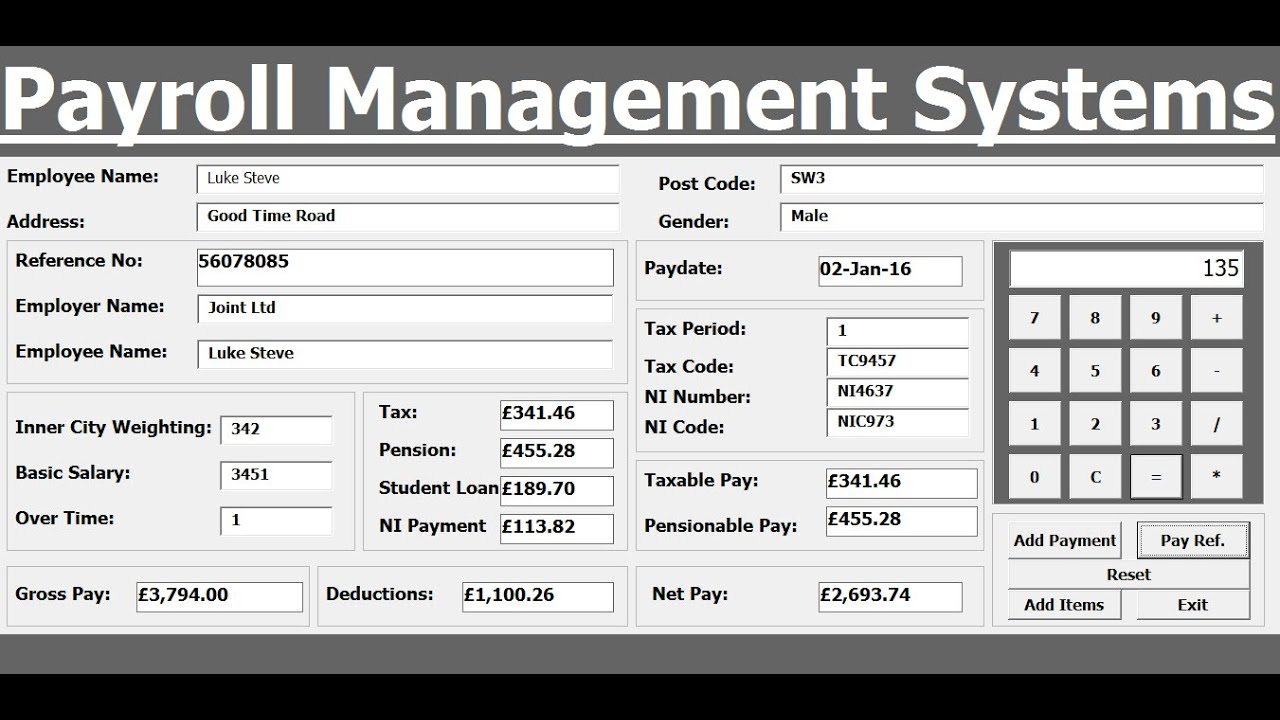

Payroll calculator with overtime and taxes

To try it out enter the employees name and location into our free online payroll calculator and select the salary pay. ADVANTAGES OF OUTSOURCING PAYROLL PROCESSING.

Pay Stub Calculator Templates 13 Free Docs Xlsx Pdf Payroll Template Life Planning Printables Spreadsheet Template

For entering information using the 24 hour clock see our Time Card Calculator with Military Time.

. You can use the payroll calculator sheet as a pay stub showing tax withholdings and other deductions gross and net pay and an itemized list of hours by type. As a new employer I set out to create a Payroll Calculator but in the process learned that there were too many laws and regulations associated with payroll to risk using a spreadsheet for calculating payroll. Along with payroll-related taxes and withholding New York employers are also responsible for providing employees with State Disability Insurance SDI to cover off-the-job injury or illness.

You will need to use Form 941 to file federal taxes quarterly and Form 940 to report your annual FUTA tax. Not paying your payroll taxes on time or leaving tax penalties unpaid can result in serious financial penalties levied on your business. The maximum overtime hours are 48 hours per working week.

It can also be used to help fill steps 3 and 4 of a W-4 form. Use this calculator to estimate the actual paycheck amount that is brought home after taxes and deductions from salary. The Fair Labor Standards Act FLSA states that any work over 40 hours in a 168 hour period is counted as overtime since the average American work week is 40 hours - thats eight hours per day for five days a week.

Annual overtime cannot exceed 150 hours. Overtime laws follow the typical overtime in Canada structure of 15 times the standard pay for more than 40 hours worked per week. Overtime Calculator More - Free.

But the daily structure is unique in both hours worked and compensation given. Overtime is due after working the maximum hours of 45 hours in one week and is paid at the statutory rate of 20000 of the employees regular pay if the overtime is worked at night on Sundays or non-working days. Allow pop-ups to be able to print the Hour Calculator.

These maximums are 48 hours a week. More details about employment tax due dates can be found here. She is entitled to overtime for 3 hours at 15 times her hourly rate.

A bonus tax calculator or payroll software that calculates and remits payroll tax automatically can help. Because of the complex nature and various facets of payroll many companies choose to outsource payroll services. When an employee is requested to work overtime or work on holidays there are maximums in relation to the number of hours allowed.

Choose Tax Year and State. British Columbia Overtime. But instead of integrating that into a general.

To get her net pay youll have to factor in deductions and taxes. I did create a Paycheck Calculator to estimate tax withholdings and calculate net take home pay. Payroll taxes are taxes employers pay on behalf of their employees.

The exact amount of tax is determined by each employees salary wage and tips. Use the Right Arrow or Left Arrow to choose between AM and PM. Alabama Payroll Tax Resources.

If you dont want to use a conversion calculator like the one above another basic tool is a decimal conversion chart. Tax Information Income Tax Withholding Federal Income Tax Withholding on Wages. All overtime hours in excess of 37 hours a week are paid at an overtime compensation rate of between 15000 and 20000 of the employees regular pay rate depending on the.

Payroll refers to how employers pay their employees. Remember to include overtime pay which is typically 15 times the normal hourly rate if the employee works more than 8 hours a day or 40 hours a week. The state allows employers to withhold 05 of wages but no more than 060 per week from employees to help fund this policy.

This calculator is intended for use by US. Use the register to track employee information such as salary pay schedule vacation hours exemption status deductions and more. As employers state agencies and institutions of higher education must deduct federal income tax FIT from wages of a state officer or employeeFIT is computed based on current tax tables and on the designations and exemptions claimed by the employee on his or her W-4 form.

Minutes to Decimals Time Conversion Chart. Hours Pay and Who is Covered. Payroll Taxes Taxes Rate Annual Max Prior YTD CP.

This overtime of 54 is added to her regular hourly pay of 480 40 hours x 12 for a total of 534. Deducting and remitting the right amount of taxes from your employees bonuses saves everyone from tax-day hassles down the roadwhich ensures bonuses feel like perks not a prelude to end-of-year tax stress. 3Email it or print it.

Payroll covers all aspects of employee pay from preparing checks and withholding taxes to keeping records of every employees pay throughout the year. Manually converting employee hours and minutes to decimal values hundredths is time-consuming and prone to errors. British Columbia still follows the same eight-hour workday but employees receive the standard 15 times their.

Federal Income Tax Withheld. Gusto has a free employer tax. The paycheck calculator is designed to estimate an employees net pay after adding or deducting things like bonuses overtime and taxes.

If her hourly rate is 12 she receives overtime at the rate of 18 for 3 hours totaling 54 of overtime. Regular overtime holiday vacation or sick time. Determine overtime pay.

You can pay taxes online using the EFTPS payment system. 2Enter the Hourly rate without the dollar sign. Sandy works 43 hours in one week.

However many employees work unusual shifts and go above and beyond this standard putting in more than. Just in case you want to learn even more about Alabama payroll taxes here are a few. Please keep in mind that this calculator is not a one-size-fits-all solution.

Salary Calculator Template Google Docs Google Sheets Excel Apple Numbers Template Net Salary Calculator Salary Calculator

Ms Excel Printable Payroll Calculator Template Excel Templates Payroll Template Excel Templates Payroll

Hourly Paycheck Calculator Hourly Payroll Calculator Payroll Paycheck Calculator

Access Database For Small Business Payroll Software And Tax Templates Access Database Payroll Software Payroll

Balance Sheet Templates 15 Free Docs Xlsx Pdf Balance Sheet Template Balance Sheet Accounting

Hourly Paycheck Calculator Templates 10 Free Docs Xlsx Pdf Salary Calculator Paycheck Pay Calculator

9 Ready To Use Salary Slip Excel Templates Exceldatapro Excel Templates Payroll Template Salary

12 Free Time Sheet Templates Printable Word Excel Pdf Samples Timesheet Template Doctors Note Template Sign In Sheet Template

How To Pay Your Nanny S Taxes Yourself Nanny Tax Nanny Payroll Payroll Template

Building Maintenance Checklist Templates 7 Free Docs Xlsx Pdf Maintenance Checklist Checklist Template Checklist

Health And Fitness Schedule Example Workout Calendar Easy Workouts Workout Schedule

How To Create Payroll Management Systems In Excel Using Vba Youtube Payroll Management Excel

Payroll Processing Services Haryana Payroll Legal Services Payroll Taxes

Printable Pdf Timesheets For Employees Time Sheet Printable Timesheet Template Attendance Sheet Template

Use This Template To Calculate And Record Your Employee Payroll Three Worksheets Are Included One For Employee Payroll Bookkeeping Templates Payroll Template

Pay Stub Examples And Importance Is Our Article Which Is Meant To Provide Basic Details About Pay Stub Formats Payroll Template Good Essay Resume Template Free

Award Winning Cloud Based Hr Payroll Software In Singapore Video Payroll Software Hospitality Design Hrms